Sage Intacct makes Continuous Accounting a reality in Release 4 2020 by continuing to strengthen its AI (Artificial Intelligence) and ML (Machine Learning) functionality.

The premise behind Continuous Accounting is that if you can capture data in real-time, automate your reconciliations, and eliminate manual adjustments then you are able to say goodbye to the tedious close process. Not only that but if you have multiple entities to consolidate then this can happen day by day as well rather than having to wait until the end of the month.

Sage recently carried out a survey to look at the typical close process; how many of the finance team does it take and how quick does the close happen?

Only about a quarter of companies (26%) surveyed were able to close in a week or less. By contrast nearly three quarters (69%) take up to three weeks.

Sage Close Survey

Sage Close Survey

So how well do you compare? Imagine the value you could bring to your business if you were able to provide up to the minute information across all the business drivers that matter to you. The good news is that with Sage Intacct this is now a reality.

Sage Intacct Intelligent GLTM

Our early adopters can now take advantage of Sage Intacct Intelligent GLTM that will enable finance teams to ensure the accuracy and integrity of their financial data. The key element of Intelligent GLTM in this release is the AI powered functionality that spots potential posting errors in your journal entries know as Outlier Detection.

Sage Intacct's powerful and innovative general ledger already provides the extensive visibility, scalability, and flexibility companies need to grow their business. Outlier Detection for General Ledger uses AI to automatically analyse journal entries and flag potential errors that may need a closer look to deliver continuous trust in financial data. This trust is enhanced by not only flagging journal entries, but giving a reason why they were flagged.

Customer surveys have shown that between 10% and 20% of journal entries typically need adjustment after being posted to the general ledger. These adjustments require extra employee time to find, correct, and document. Outlier Detection for General Ledger uses the power of AI to provide insights to catch potential errors and risks before they post. It reduces the cost of ensuring accuracy and enables finance teams to trust their financial information sooner—without having to wait for the close. Put simply, Outlier Detection for General Ledger enables organisations to analyse all journal entries that require approval, all of the time, as opposed to some of the entries, some of the time.

Intelligent Insights

Companies using Sage Intacct that adopt the concept of continuous accounting and then have timely information with accuracy they can trust will also need continuous insight into that information. That is why Sage Intacct provides tools to analyse that information to gain insight. The latest addition to that toolset, is the Sage Intacct Interactive Visual Explorer—enabling business analysis and insights using advanced visualizations and real-time source data.

The Sage Intacct Interactive Visual Explorer launches finance teams beyond basic monthly reporting, enabling proactive decision making based on multidimensional graphical analysis and collaboration. Business leaders can easily look across and through the real-time performance of their business, giving more context to financials, comparing data over time, and spotting trends as they occur. The Interactive Visual Explorer allows companies of all sizes to identify emerging opportunities and risks they might not have otherwise been able to discover and then drill down into the data.

Sage Intacct’s Intelligent Time

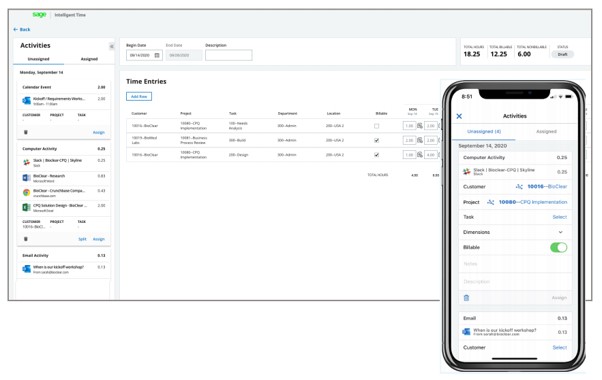

Sage Intelligent Time is an artificial intelligence (AI) powered application built directly into the Sage Intacct platform. Sage Intelligent Time provides continuous, timely, and more accurate insights to better manage billable time in services-based businesses. It uses an AI-powered personal time assistant to enable service professionals to complete their timesheets more quickly and accurately by automatically reconstructing their workday—helping to ensure all billable time is captured to reduce revenue leakage, improve project profitability, and increase revenues.

Sage Intacct Intelligent Time

Sage Intacct Intelligent Time

The future is already here . . .

Although some of you may worry that AI and ML will put finance teams out of business, we disagree. Instead, we see these technologies offering the opportunity to change the role of finance, to increase its value to the business. These technologies will automate tasks, speed up calculations and provide easier access to a richer set of business information in real time. Finance professionals will still be needed to provide the analysis, interpret the results in context and provide guidance to the wider business.

Financial professionals that lead the charge and help their businesses take advantage of AI and ML will have time to focus on more strategic aspects of the business and deliver more value to their organisations.

If you are interested in finding out more about Sage Intacct then contact us.